Navigating Bank Holidays In 2025: A Guide For Financial Planning And Awareness

Navigating Bank Holidays in 2025: A Guide for Financial Planning and Awareness

Related Articles: Navigating Bank Holidays in 2025: A Guide for Financial Planning and Awareness

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating Bank Holidays in 2025: A Guide for Financial Planning and Awareness. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Bank Holidays in 2025: A Guide for Financial Planning and Awareness

The Reserve Bank of India (RBI) plays a crucial role in regulating the financial system and ensuring its smooth functioning. A key aspect of this role involves the declaration of bank holidays, which impact the availability of banking services and financial transactions. Understanding these holidays is essential for individuals and businesses alike, as it directly affects financial planning and operational efficiency.

Understanding Bank Holidays in India

Bank holidays in India are officially declared by the RBI, and they are categorized into two types:

- Observed Holidays: These are days when banks remain closed throughout the country, regardless of the specific location.

- Optional Holidays: These holidays are specific to particular states or regions and are observed at the discretion of individual banks.

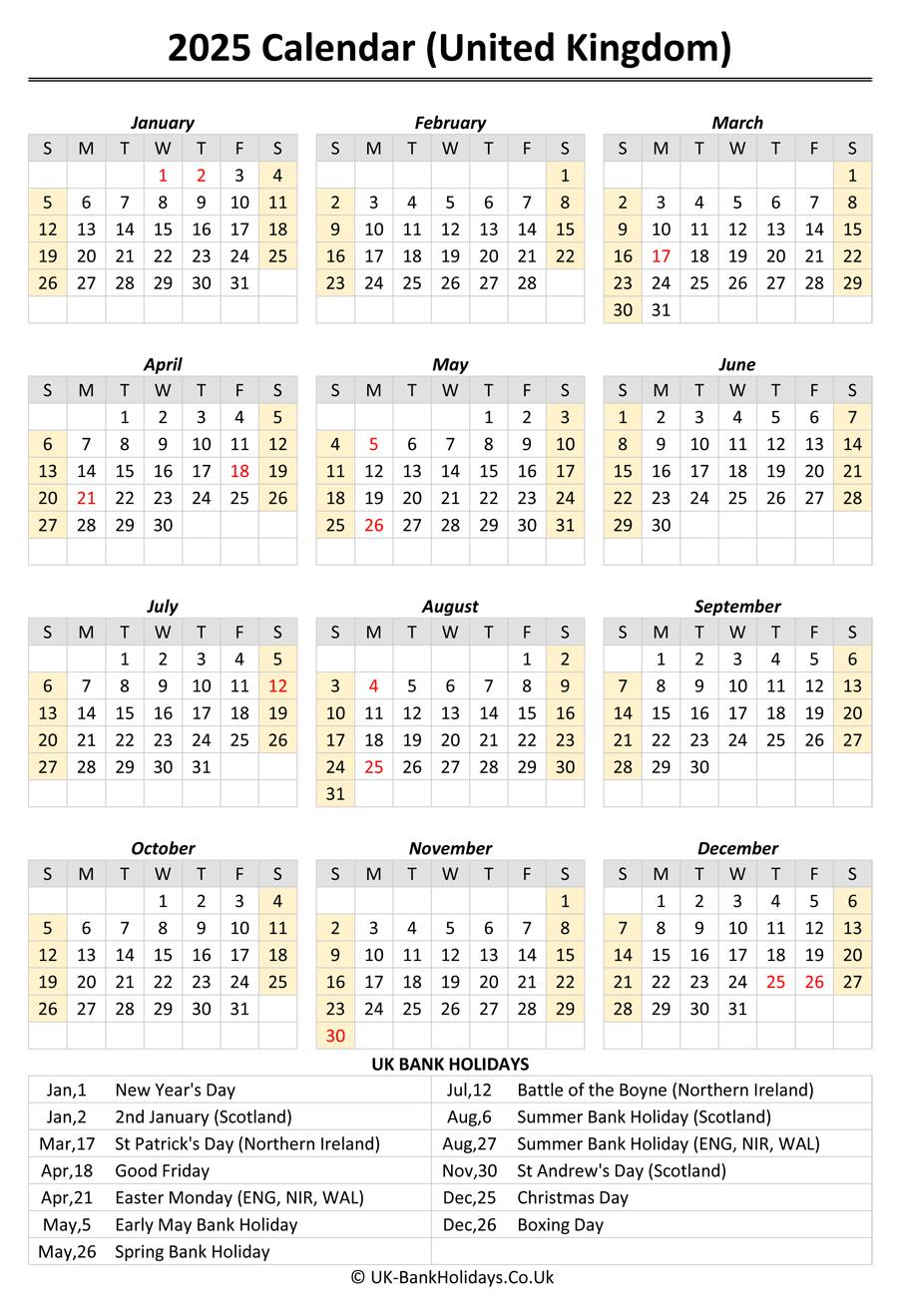

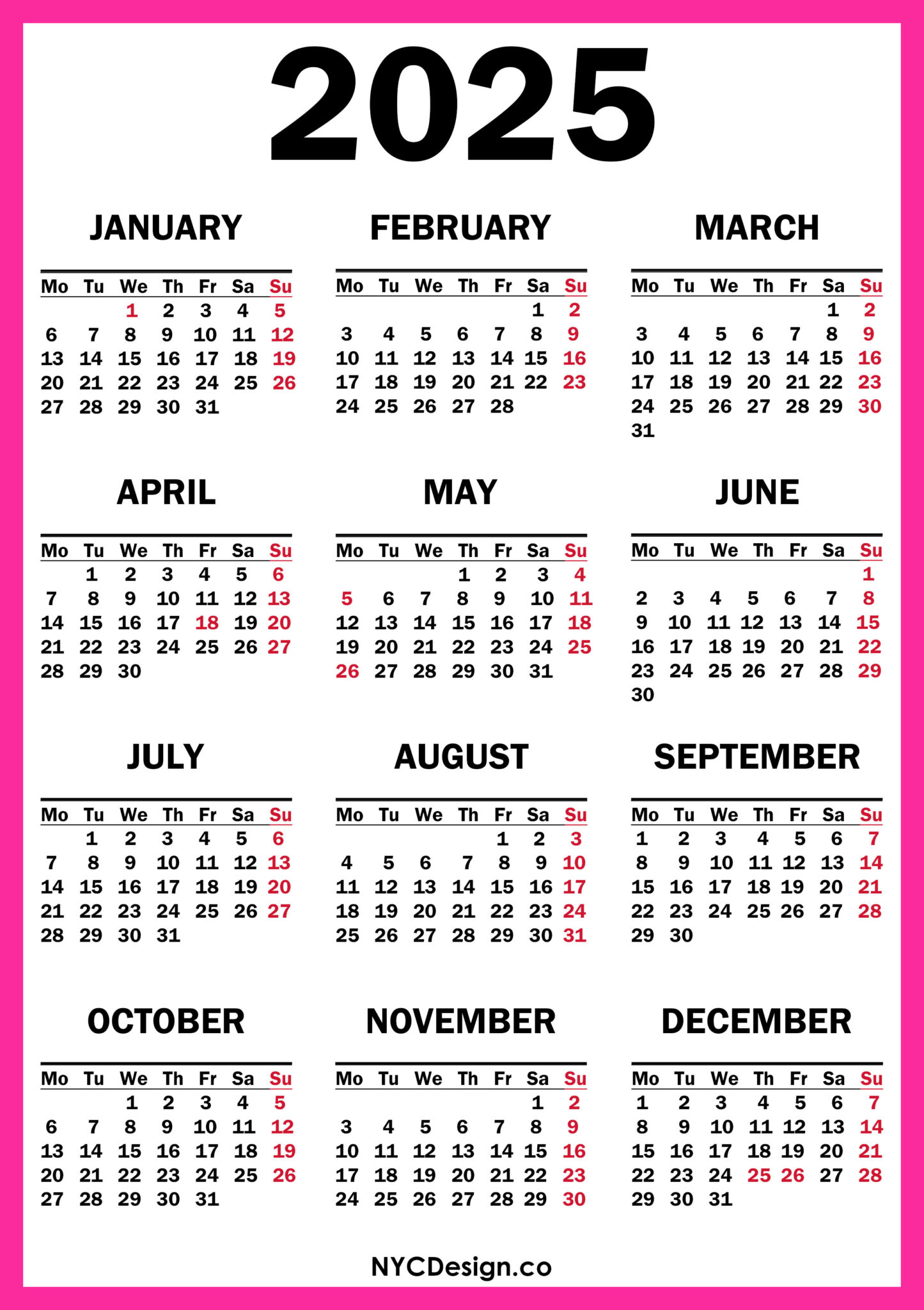

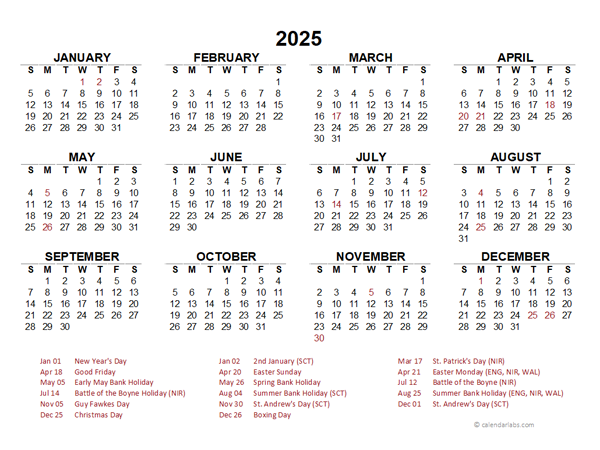

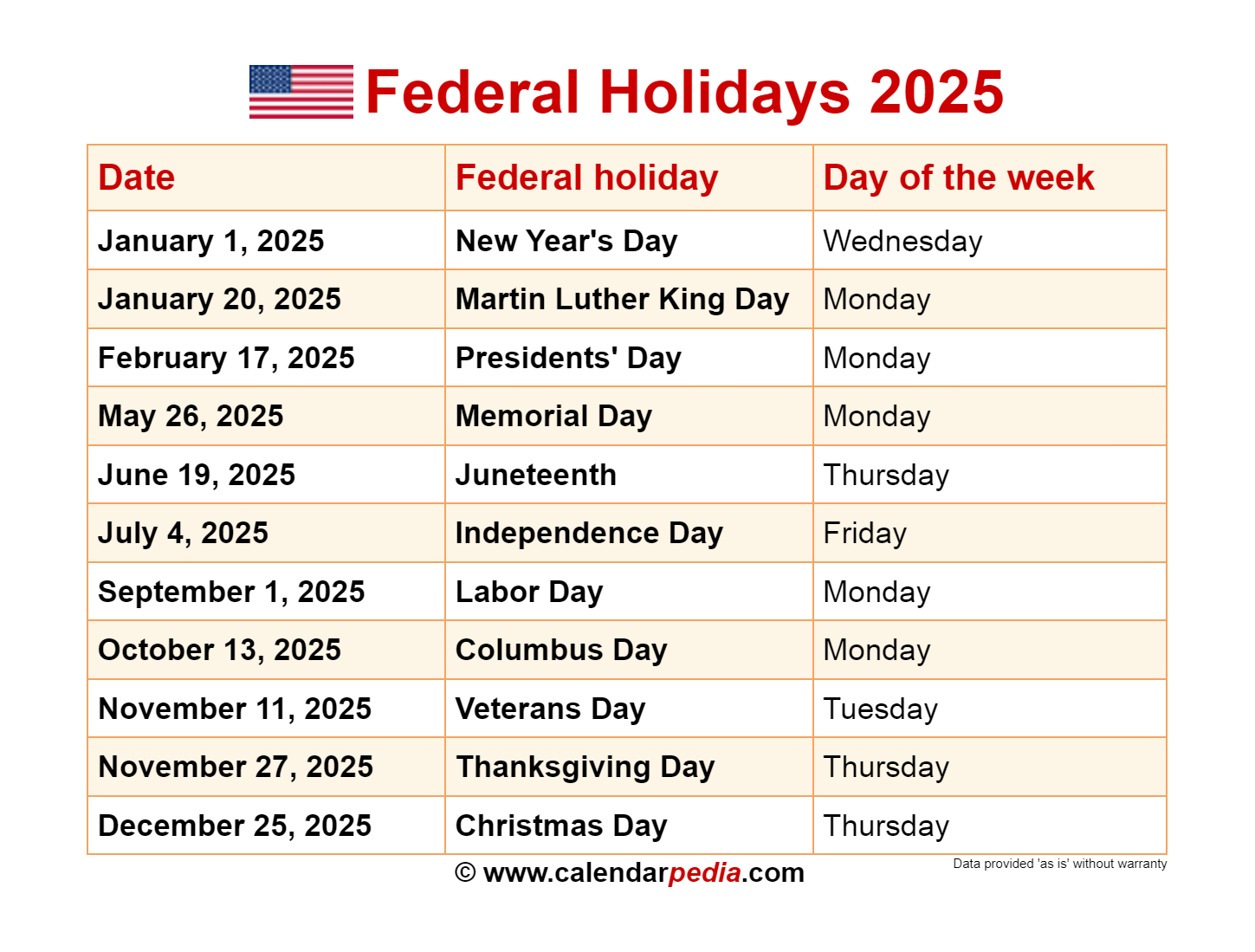

The RBI publishes a calendar of bank holidays each year, which provides a comprehensive list of all observed and optional holidays for the upcoming year. This calendar serves as a vital resource for individuals and businesses to plan their financial activities accordingly.

The Significance of Bank Holidays in 2025

While bank holidays are a time for rest and celebration, they also have a significant impact on the financial sector. Understanding these implications is crucial for individuals and businesses to avoid potential disruptions and ensure seamless financial operations.

Impact on Financial Transactions:

- Reduced Banking Services: During bank holidays, most banking services, including branch operations, online banking, and mobile banking, are limited or unavailable.

- Delayed Transactions: Transactions initiated on bank holidays may be processed on the next working day, leading to potential delays in payments and fund transfers.

- Impact on Market Operations: Stock markets and other financial markets may also remain closed on bank holidays, affecting trading activities and investment decisions.

Planning for Bank Holidays:

- Financial Planning: It is essential to plan financial transactions, such as bill payments, salary transfers, and loan repayments, well in advance of bank holidays to avoid any last-minute inconvenience.

- Cash Management: Individuals and businesses should ensure sufficient cash reserves to manage essential expenses during bank holidays when access to banking services is restricted.

- Investment Decisions: Investors should consider the impact of bank holidays on market operations and plan their investment activities accordingly.

FAQs Regarding Bank Holidays in 2025

1. What are the observed bank holidays in 2025?

The RBI’s annual calendar for bank holidays in 2025 will list all observed holidays. This information is readily available on the RBI website and various financial news portals.

2. What happens to my online banking transactions on a bank holiday?

While some online banking services may be available, certain functionalities, such as fund transfers and bill payments, may be restricted. It is advisable to check the specific services offered by your bank during bank holidays.

3. How do I ensure my salary is credited on time if my payday falls on a bank holiday?

Salaries are typically credited on the next working day following a bank holiday. It is essential to check with your employer regarding their salary disbursement process.

4. Can I withdraw cash from an ATM on a bank holiday?

While ATMs are generally available on bank holidays, it is advisable to check the availability of cash at your preferred ATM beforehand.

5. What happens to my loan repayments due on a bank holiday?

Loan repayments due on bank holidays are typically processed on the next working day. However, it is recommended to contact your lender to confirm their specific repayment policies.

Tips for Managing Bank Holidays in 2025

- Stay Informed: Regularly check the RBI website and your bank’s website for updates on bank holidays and their impact on banking services.

- Plan Ahead: Schedule all important financial transactions, such as bill payments, salary transfers, and loan repayments, well in advance of bank holidays to avoid any last-minute disruptions.

- Maintain Sufficient Cash: Ensure adequate cash reserves to manage essential expenses during bank holidays when access to banking services is limited.

- Utilize Alternative Payment Methods: Consider alternative payment methods like mobile wallets and online payment gateways for transactions during bank holidays.

- Contact Your Bank: If you have any queries or concerns regarding banking services during bank holidays, contact your bank for clarification.

Conclusion

Bank holidays in India, as declared by the RBI, are an integral part of the financial calendar. While they provide opportunities for rest and celebration, it is essential for individuals and businesses to understand their implications and plan their financial activities accordingly. By staying informed and proactively managing their financial affairs, individuals and businesses can navigate bank holidays smoothly and minimize any potential disruptions to their financial operations.

Closure

Thus, we hope this article has provided valuable insights into Navigating Bank Holidays in 2025: A Guide for Financial Planning and Awareness. We thank you for taking the time to read this article. See you in our next article!